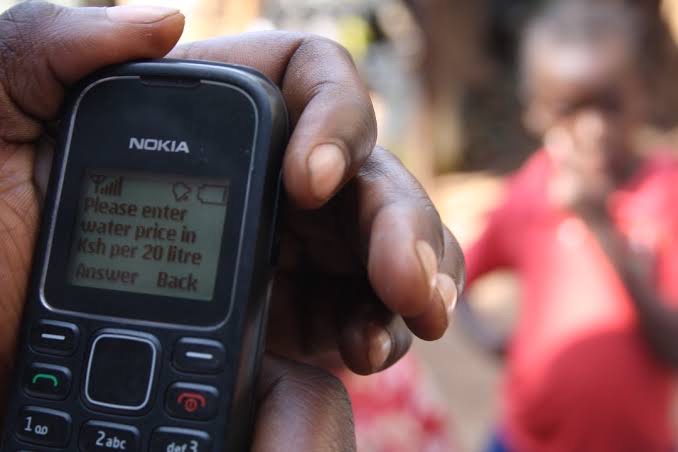

Despite the proliferation of other payment methods, like as applications and QR codes, Africans still favor using USSD to pay for banking and mobile money services. Due to its easy-to-use interface that does not necessitate a smartphone or internet connectivity, USSD-based transactions were employed for mobile money and cross-domain transactions. As of June 2023, USSD channels accounted for 70% of instant payment channels and played a crucial role in enabling transactions beyond the scope of conventional mobile money services, such as those conducted between separate banks.

Customers in Ghana and Kenya prefer mobile money systems to card-based systems because they are more convenient and accessible. This significant preference is in line with the statistics showing that 60% of Ghanaians and 69% of Kenyans have access to mobile money accounts. While USSD has widespread adoption, its complexity has been mentioned as an obstacle to its implementation in payment systems. “Complex USSD menus and failed transactions are particularly detrimental to use,” claimed AfricaNenda, a digital payment strategy organization, in its inclusive instant payment systems (IIPS) study.

Read also: The Central Bank Of Nigeria Unveils USSD Code For eNaira Transactions

Interoperability between financial institutions is made possible by cross-domain instant payment systems, which allow for the use of mobile money in conjunction with traditional bank accounts. In spite of app channels’ close proximity to USSD in terms of usage, the adoption of smartphones and internet connectivity is still relatively low (51% and 43.2%, respectively).

Quick Response (QR) Codes Are Becoming More Popular As Another Channel. Mobile money quick payments often favor agent, USSD, and app channels, while cross-domain and bank IPS offer the widest variety of channels. An instant payments systems (IPS) report published by AfricanNenda in November 2023 suggests that this variety is indicative of the developing financial services ecosystem in Africa.

AfricaNenda reports that e-money instruments including mobile money and cross-domain rapid payment systems have found significant use. Cross-domain systems also use commercial money instruments like credit and debit electronic funds transfer (EFT), while bank IPS focus on credit EFT, with debit EFT as a secondary instrument. This variety exemplifies the various approaches to monetary exchange that exist within the various payment systems.

IPSs that can switch between commercial money instruments (including debit EFT, credit EFT, and domestic card instruments) and e-money instruments are considered cross-domain systems. There are two ways that operators can accomplish a cross-domain IPS, as stated by AfricaNenda.

The need for immediate digital payments is increasing, making IIPS crucial. The percentage of adults in Sub-Saharan Africa who use digital payments will increase to 50% by 2021 from 34% in 2017.

About AfricaNenda

AfricaNenda is an independent, African-led organization that strives to remove barriers and speed universal access to digital payments in Africa. They see rapid and inclusive payment systems as crucial to achieving universal financial inclusion in Africa by 2030, since they can help make financial services available to previously unbanked adults. Regional economic communities, private sector associations, central banks, and government ministries receive technical support, secondments, training, networking and collaboration, best practices, knowledge resources and tools, policy assistance, and capacity building from these organizations.