In a strategic move aimed at enhancing financial inclusion and convenience for South African consumers, Telkom, a leading telecommunications provider, has partnered with Clickatell, a global leader in mobile messaging and payments, to introduce mobile messaging payments. This innovative service revolutionizes the way transactions are conducted, leveraging the ubiquity and accessibility of mobile phones to facilitate seamless and secure financial transactions across the country.

Read also: Telkom is in talks with stock investors concerning Swiftnet

The Significance of the Partnership

The partnership between Telkom and Clickatell marks a significant milestone in the evolution of mobile payments in South Africa. By combining Telkom’s extensive network infrastructure and customer reach with Clickatell’s expertise in mobile messaging and payments, the collaboration promises to bring about a paradigm shift in the way people transact, particularly in underserved and remote areas where traditional banking services may be limited.

Empowering Financial Inclusion

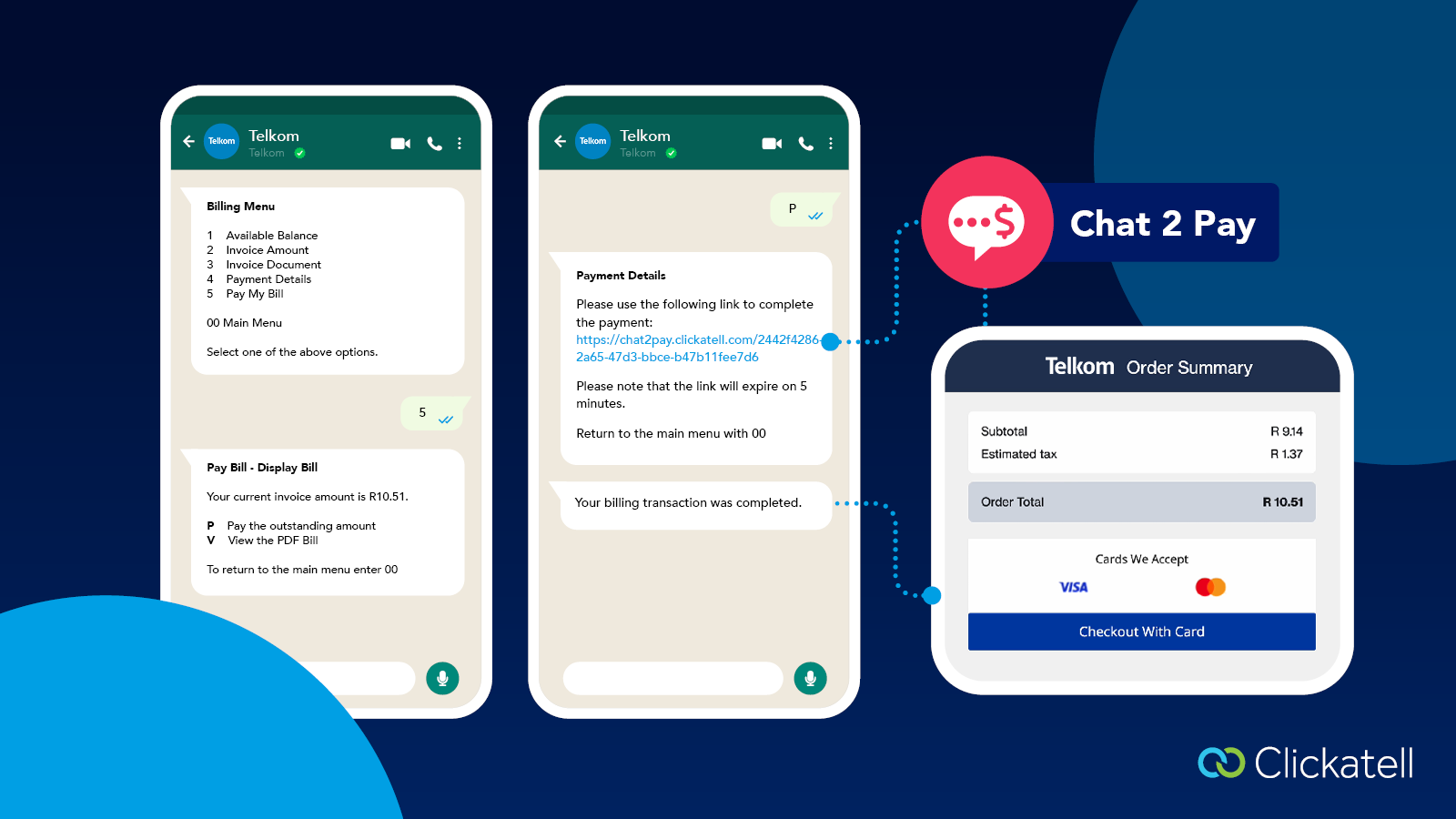

One of the key objectives of the Telkom-Clickatell partnership is to promote financial inclusion by providing a convenient and accessible payment solution to all segments of society. With mobile phones becoming increasingly prevalent across South Africa, even in rural and marginalized communities, the ability to conduct financial transactions via SMS opens up a world of possibilities for millions of people who may not have access to traditional banking services. Whether it’s paying bills, transferring money to family members, or making purchases, mobile messaging payments offer a simple and user-friendly alternative to cash transactions.

Enhancing Convenience and Accessibility

The introduction of mobile messaging payments not only empowers consumers but also benefits merchants and businesses by offering a more efficient and cost-effective payment solution. With just a few taps on their mobile phones, customers can complete transactions securely and instantly, without the need for physical cash or cards. This not only streamlines the payment process but also reduces the risks associated with carrying cash, thereby enhancing security for both buyers and sellers. Moreover, the accessibility of mobile messaging payments means that businesses can reach a wider customer base and tap into new markets, driving growth and economic development.

Ensuring Security and Trust

In an era where cybersecurity threats are increasingly prevalent, ensuring the security and integrity of financial transactions is paramount. The Telkom-Clickatell partnership places a strong emphasis on security, implementing robust encryption and authentication measures to protect the privacy and confidentiality of user data. By leveraging cutting-edge technology and industry best practices, the mobile messaging payments platform offers users peace of mind knowing that their transactions are secure and tamper-proof. This not only fosters trust and confidence among consumers but also encourages greater adoption of digital payment solutions, driving the transition towards a cashless society.

The collaboration between Telkom and Clickatell to launch mobile messaging payments in South Africa represents a significant step forward in the evolution of digital finance in the region. By harnessing the power of mobile technology and leveraging the extensive reach of Telkom’s network, the partnership promises to empower consumers, drive financial inclusion, and stimulate economic growth. With convenience, accessibility, and security at its core, mobile messaging payments have the potential to transform the way people transact, paving the way for a more inclusive and prosperous future for all South Africans.