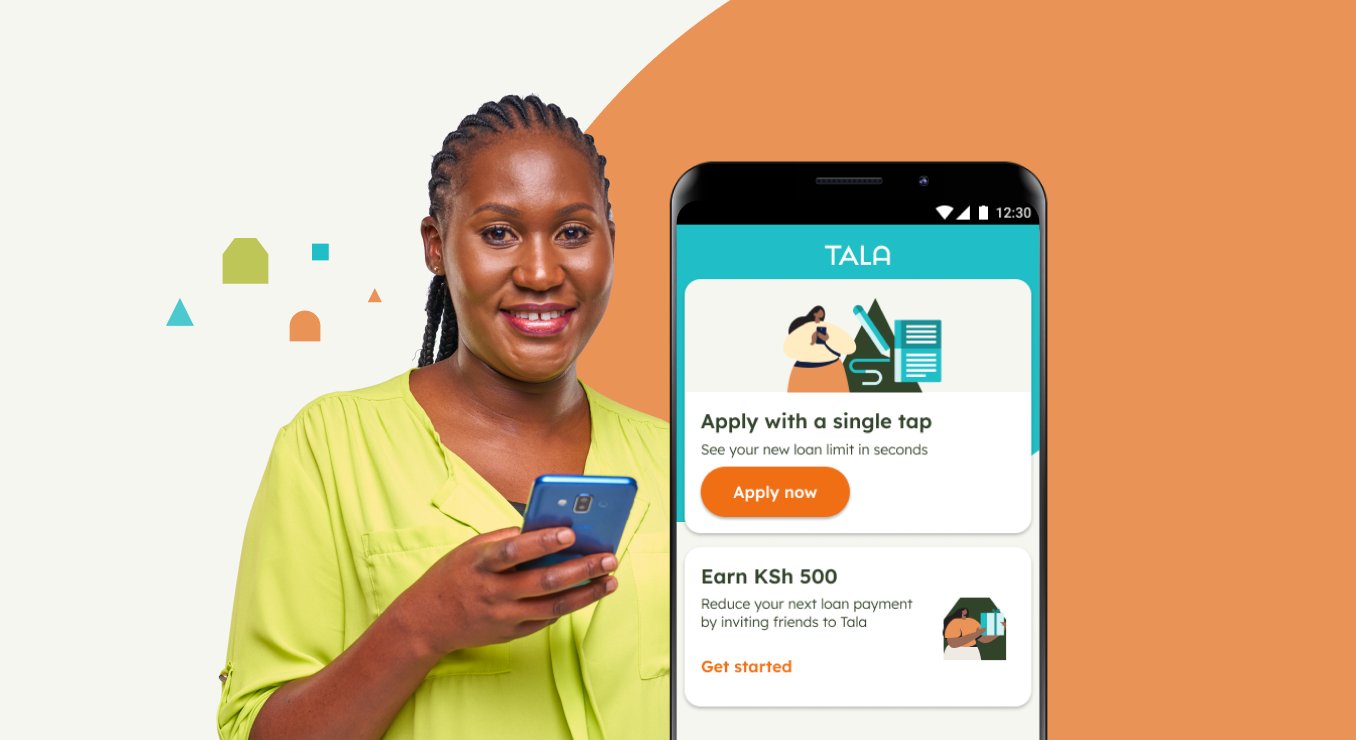

Tala Kenya, a prominent digital lender, is gearing up to broaden its financial services portfolio by introducing a savings product tailored for its extensive customer base of over 3.5 million users.

The strategic move aims to position Tala as a comprehensive financial services provider, catering to diverse financial needs within its ecosystem.

Read also: Bokra, Egyptian fintech secures $4.6 million to support SMEs

Tala Launch of Savings Feature

Annstella Mumbi, General Manager of Tala Kenya, unveiled the company’s upcoming initiative to pilot a new savings feature later this year, with a full-scale launch anticipated by early next year.

Mumbi emphasised the vision behind this development, stating, “We want customers to be able to transact, save, and invest within the Tala app. Hopefully, we should start testing this year and launch by the end of the year or early next year.”

Tala’s journey into savings products is strategically aligned with its mission to enhance customer financial well-being, offering a seamless platform for transactions, payments, savings, and investments, all within the Tala app. This move sets the stage for direct competition with Branch Kenya, a key player in the market that already provides a similar savings service and recently expanded its capabilities by acquiring a majority stake in Century Microfinance Bank.

Regulatory Landscape and Strategic Direction

While exploring options for expansion, Tala considered the prospect of acquiring a microfinance institution. However, Mumbi highlighted the absence of a regulatory framework for digital or neo-banks in Kenya as a critical factor influencing their strategic decisions. She emphasised, “My stand is that we don’t yet have a regulatory framework for digital or neo-banks for this market, and until this becomes true, the acquisition could not fit into what Tala is looking to do.”

Read also: Axmed secures $7M investment to pioneer access to medicines in low and middle income countries

Tala and other digital lenders actively engage with regulatory authorities to propose changes to facilitate nonbank operations in the Kenyan market. This proactive approach underscores Tala’s commitment to navigating regulatory challenges while expanding its financial services offerings to serve its growing customer base better.

Tala’s venture into savings products marks a significant step towards diversifying its financial services and solidifying its position as a leading digital lender in Kenya and beyond. With a focus on innovation, customer-centric solutions, and strategic growth initiatives, Tala continues to drive financial inclusion and empowerment across emerging markets, embodying its mission to provide accessible and impactful financial services to underserved communities.