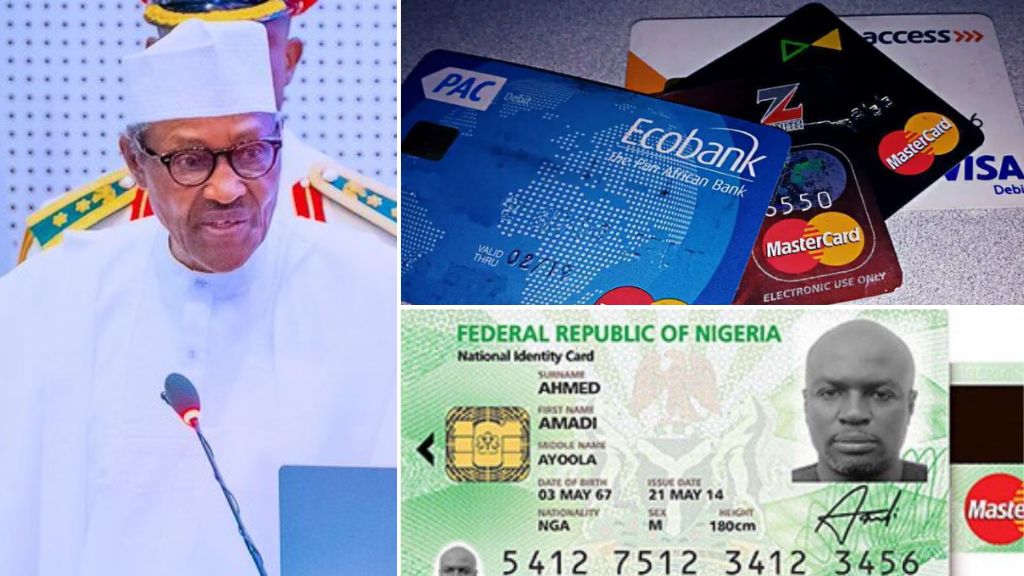

Nigerians can now get a single card (called a Multipurpose Card) that serves both as an ATM card and an identity card.

This is a ground-breaking new development in the country. And there won’t be any more expenses for this at all. It seems like the days of carrying around a wallet full of different cards are drawing to a close one by one.

A few days ago, the government gave the nation’s commercial banks the green light to begin issuing multipurpose cards. These cards combine ATM access and the National Identity Number (NIN) onto a single piece of plastic. The authority was granted to the commercial banks in the country.

This decision, which was announced by the Federal Government, is intended to simplify identification and financial services while also offering considerable benefits to the inhabitants of Nigeria.

This action is being taken in response to the growing demand for actual NIN cards, which has been particularly prevalent among rural populations.

By working together with NIMC and taking advantage of the infrastructure already in place at commercial banks, the government hopes to make the lives of its residents easier while also expanding access to financial services.

Read also: How to check your NIN number on MTN, Airtel, 9mobile, and Glo

Benefits of the ATM card initiative for Nigerians

Implementing cards that can be used for various purposes offers Nigerians a number of benefits. To begin, people won’t have to carry around two different cards any longer if they want to use one for banking and the other for identity purposes.

The unification of these services into a single card not only improves convenience but also lessens the likelihood of losing or misplacing crucial paperwork.

In addition, the provision of these multipurpose cards at no cost removes any monetary constraint that may have previously prevented residents from acquiring the actual NIN card due to the expenses that were involved with its acquisition.

Simplifying and streamlining the procedure

After a meeting, the Federal Executive Council, which will soon be led by a new president, Muhammadu Buhari, gave its approval to the decision in order to assure that it will be carried out without a hitch.

Professor Isa Pantami, the Minister of Communications and Digital Economy, emphasised that the cards will act as both a national identity card and a bank card, integrating seamlessly the ATM capabilities of major providers like as Mastercard and Visa.

Cooperation, as well as the protection of data

The Nigerian Interbank Market Corporation (NIMC) and the Central Bank of Nigeria (CBN) have both signed a nondisclosure agreement in order to secure the personal information of card applicants. This was done since both organisations understood the significance of privacy and confidentiality.

Banks must link to the NIMC database in order to validate an individual’s specific information as part of the process of getting the multifunctional card. After the verification has been finished, the card will be printed and distributed straight away, making the process as quick and effective as possible for the citizens.

According to data available as of January 2023, the commission was successful in adding 21.3 million persons to the database in 2022, bringing the total number of citizens in the country to 94,037.793 at the end of the previous year. It is important to note that as of January 2022, the total number of NINs that had been granted was 72,700,360.

Increasing the Degree of Integration

The deployment of an automated system that merges NINs with individual SIM cards was also approved by the Federal Executive Council, in addition to the introduction of multifunctional cards, which was also approved by the Federal Executive Council.

This change is being made with the intention of streamlining the process of tying NINs to SIM cards in order to improve the policy’s implementation better.

The determination of the government to improve efficiency and encourage a smooth convergence of identity verification and financial services is highlighted by the government’s commitment to embracing technology developments as they become available.

As the NIN is the primary identity for Nigerians, the Nigeria Communications Commission (NCC) believes that the integration of NIN and SIM will significantly improve national security. Furthermore, the NIN-SIM database will improve citizens’ access to government services, which is in line with the Federal Government’s commitment to ensure that Nigeria deploys technology to improve service delivery.

The decision made by the government of Nigeria to implement multipurpose cards that combine ATM access and the NIN is a significant step forward in the effort to streamline identification and banking procedures for the country’s population. This effort streamlines services, lowers the need for several cards, and offers a straightforward solution to satisfy the expectations of both urban and rural population demographics.

The goal of the government is to develop an all-inclusive and effective card that combines ATM access and NIN services, and they plan to do this by capitalising on the relationship that exists between the NIMC and commercial banks.

This new achievement demonstrates the government’s dedication to enhancing the lives of its people via the application of technology and expanding access to financial services throughout the country of Nigeria.

Despite this, there is still a concern over the prompt and problem-free implementation of this project.