Microsoft, Meta and Twitter have been reported to begin silent layoff of employees. Microsoft is set to begin the layoff of about one thousand (1,000) employees in its different divisions, including the Xbox and the Edge Teams.

Meta is reportedly conducting `quiet layoffs` at its Facebook arm that may lead to thousands of job cuts, at least 12,000 or about 15 per cent of its workforce. This is in a bid to slow down its workforce as macroeconomics headwinds and falling ad spending continues to impact the tech industry.

Earlier in July, tech giant Microsoft had said that a small number of roles had been eliminated and that it would increase its employee count down the line. In a released statement, Microsoft said, “Today we had a small number of role eliminations. Like all companies, we evaluate our business priorities regularly and make structural adjustments accordingly.”

This also applied to Meta, which announced a pause in its hiring process as the fear of a global recession continues to loom. Now, the silicon valley tech giant is set to lay off 12,000 of its 80,000 employees in a bid to cut the budget and reduce headcount.

Meta had previously laid off 60 contract workers in mid-August.

Read also: Microsoft Unveils Outlook Lite For Andriod

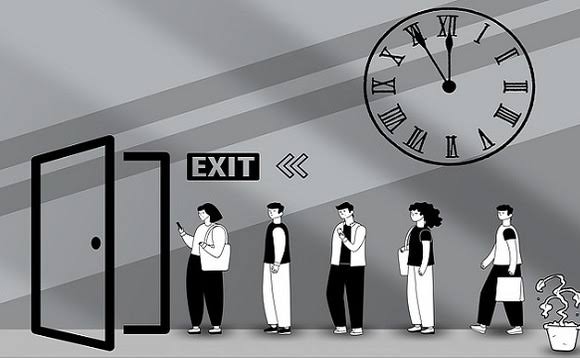

Job Seekers On The Rise

As much as 15% of Meta’s workforce could be cut within the next few weeks. This means that some 12,000 employees could be out of jobs soon. The layoffs by Microsoft affected less than 1 per cent of Microsoft’s last reported workforce of around 221,000.

A Series of technology companies have been cutting jobs or slowing hiring amid a global economic slowdown. Asides from Microsoft and Meta, several tech companies, including Twitter Inc and Snap Inc, have cut jobs and stopped hiring in recent months due to global economic slowdown, rising inflation, etc. On August 31, 2022, Snap announced its plan to reduce its headcount by approximately 20 per cent of its full-time global employees.

In a mail to the employees accessed by the media, Snap CEO Evan Spiegel said it had become clear that the company must reduce the cost structure to avoid incurring significant ongoing losses.

“As a result, we have made the difficult decision to reduce the size of our team by approximately 20%. The scale of these changes vary from team to team, depending upon the level of prioritization and investment needed to execute against our strategic priorities”, Spiegel’s mail read.

The likes of Wipro and Infosys have also announced layoffs this year. Besides attrition, many companies like Apple, Oracle, Google and others have also announced a hiring freeze for the coming months. According to the media, more than 32,000 workers in the US tech sector have been laid off in mass job cuts as of late July.

This number includes both startups and publicly traded tech companies, as well as companies with sizable teams.

Long before Microsoft and Meta got hit by the global slowdown and began quiet layoffs, many other organizations have been reported to do so in which some had to shut down their businesses. Other organizations like Sendy, 54gene, Sky.Garden, and Notify.

Global Macroeconomics Crisis

The global outlook has deteriorated markedly throughout 2022 amid high inflation, aggressive monetary tightening, and uncertainties from both the war in Ukraine and the lingering pandemic. Soaring food and energy prices are eroding real incomes, triggering a global cost-of-living crisis, particularly for the most vulnerable groups.

Growth in the world’s three largest economies, the United States, China, and the European Union, is weakening, with significant spillovers to other countries. At the same time, rising government borrowing costs and large capital outflows are exacerbating fiscal and balance of payments pressures in many developing countries.

The catalysts for the GFC were falling house prices and a rising number of borrowers unable to repay their loans. Rising borrowing prices, inflation, and debt all fuel concerns of an economic collapse, with analysis showing that Sri Lanka, Lebanon, Russia, Suriname, and Zambia are already in debt default, Belarus is on the verge of default, and at least another dozen countries are in danger of default.

Inflation is skyrocketing (currently 388 per cent), debt relief could be suspended, and humanitarian response is underfunded (36 per cent). Climate change is exacerbating flooding and drought, locust plagues present a constant threat, and food insecurity could affect up to 6 million people.

Against this backdrop, the global economy is now projected to grow between 2.5 and 2.8 per cent in 2022. The deterioration in business confidence is particularly alarming for many developing countries that are yet to recover from the pandemic fully. International food and energy prices have fallen from recent peaks but continue to be at very high levels.

Global trade remains largely subdued as global supply chain disruptions and bottlenecks in international freight movements persist.