With backing from investors including Saison Capital and Horizone, the Nigerian fintech company Kippa has transferred a large portion of its operations related to its agency banking product, KippaPay, to Bloc, another Nigerian fintech that is planning to launch banking services.

This comes after Kippa stopped offering its agency banking services in October, while the co-founder of the company characterised the arrangement as a handshake.

Following the Central Bank of Nigeria’s (CBN) approval-in-principle in November 2023, Bloc’s payment subsidiary GPay smoothly incorporates KippaPay. Because of this strategic synergy, Bloc will be able to use KippaPay’s services as part of its own growing offering.

Read also: Nigeria’s Kippa secures $8.4 million to expand service to small and medium-sized businesses

After the Naira devaluation in June, the decision to close KippaPay in October was impacted by the increased expenses of procuring POS equipment. Recouping these costs in a highly competitive market without changing agent commissions was a problem for Kippa.

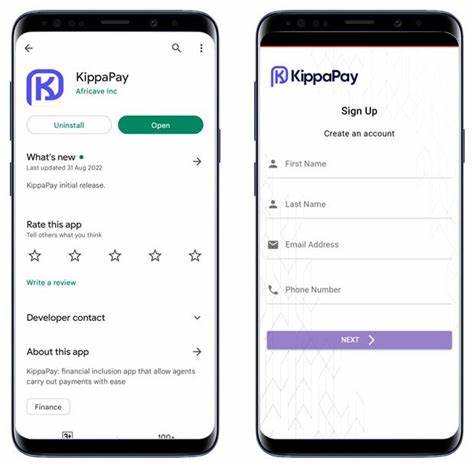

Bloc has restored full functionality on KippaPay’s mobile app and Android terminal, according to a recent notification issued to existing users. Users were also instructed in the email on how to restart using the agency banking platform for transactions.

Nevertheless, it was mentioned that the Linux terminals’ service restoration is still in the works, therefore merchants were asked to return their POS devices to Kippa. A reliable source close to Kippa has revealed that any gadgets that have not been returned will be added to the GPay pool.

Bloc has officially resumed operations, according to a spokeswoman, and all agents who were previously registered on KippaPay have been transferred to the new GPay application without any hitches. In order to make the transfer and settlement go well, they promised to communicate with more than 19,000 agents in the next weeks.

This strategic move highlights how the Nigerian fintech landscape is always changing and how industry participants are working together to improve services and adjust to consumer demands.

Kippa Obtains licence from the Central Bank of Nigeria to assist SMEs

About KippaPay

To help small and medium-sized enterprises (SMEs) in Africa expand, the Nigerian fintech firm Kippa offers digital solutions for managing finances and running a company. Designed to let SMEs in Africa send and receive payments via the Kippa app, the company’s digital payments product, KippaPay, was launched in April 2022. Having said that, KippaPay, the company’s offline payment solution, may soon be closing down as a result of worries over profitability. Many employees in the department responsible for this product will be let go when it is canned. Although the exact number of employees set to lose their jobs was not announced, the KippaPay team’s core members will depart by December 2023, according to the company. Given the outstanding effort put in by the team, Kippa’s founder and CEO Kennedy Ekezie said that the layoff was a tough decision for the company. Kippa has raised a total of $11.6 million, with $3.2 million coming from pre-seed fundraising in November 2021 and $8.4 million coming from a new financing round in September 2022.