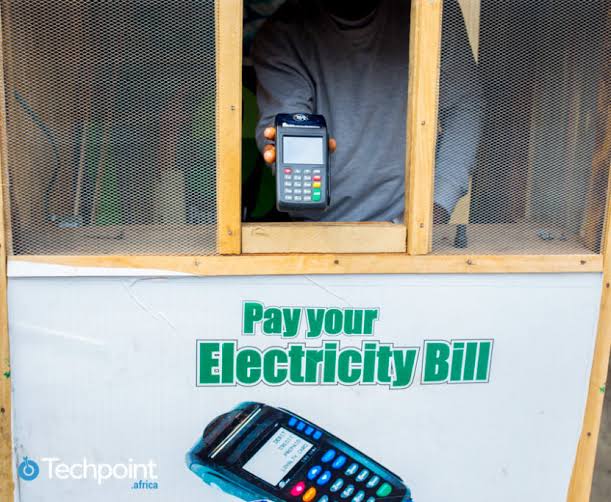

The Federal Competition and Consumer Protection Commission (FCCPC) in Nigeria has taken a strong stance against Point of Sale (PoS) operators implementing a recently declared surge in charges for PoS transactions.

This was in response to the actions of the Association of Mobile Money and Bank Agents in Nigeria (AMMBAN) to establish standardized prices for various transaction services.

The FCCPC has issued a prohibition and emphasized that price fixing is not permissible under the Federal Competition and Consumer Protection Act (FCCPA).

The FCCPC recognizes a certain level of self-regulation within professions or trades but highlights the limitations imposed by the FCCPA.

The Act explicitly prohibits any agreement or coordination among undertakings or associations to fix prices, coordinate supply, or engage in activities that can disrupt the market, hinder innovation, and fail to benefit consumers or other businesses.

Setting prices in a coordinated manner disrupts the market, hampers innovation and efficiency, and ultimately harms consumers and businesses not involved in such collaborations. The FCCPC emphasizes that price fixing is detrimental to fair competition and the overall economy.

The FCCPC warns that severe penalties will be imposed on cartels or any form of coordinated behavior among competitors, including actions taken at the association level.

Violations of the FCCPA can result in financial penalties, legal action, and reputational damage. The Commission is committed to fully enforcing the law against businesses found to be directly or indirectly involved in prohibited conduct or agreements.

Read also: Four simple steps to fix failed PoS transactions

Intervention by the Central Bank of Nigeria (CBN)

The recent surge in charges implemented by PoS agents in Nigeria has caught the attention of the Central Bank of Nigeria (CBN).

Recognizing the concerns raised by consumers and stakeholders, the CBN has announced its intention to intervene in addressing the issue. The CBN’s intervention aims to ensure that transaction charges remain reasonable, transparent, and in line with the interests of consumers and the broader economy.

Investigation and Call for Consumer Support

The FCCPC has initiated an investigation into the matter, demonstrating its commitment to enforcing fair competition and consumer protection.

The Commission appeals to consumers to provide valuable and reliable information that can aid in the investigation and enforcement process. By sharing pertinent details, consumers can play an essential role in promoting fair competition, protecting their own interests, and contributing to a thriving marketplace.

The FCCPC recognizes the importance of collaboration with industry stakeholders to address pricing concerns effectively. While the Commission acknowledges that self-regulation within professions or trades is acceptable to a certain extent, it underscores the need to comply with the FCCPA’s provisions.

The FCCPC encourages dialogue between AMMBAN, PoS operators, and other relevant parties to find mutually beneficial solutions that align with fair competition and consumer welfare.

Focus on Consumer Protection

The FCCPC’s prohibition on implementing the surge in transaction charges highlights its commitment to protecting consumers in Nigeria.

The Commission aims to ensure that transaction costs remain affordable and reasonable for consumers across various socio-economic segments. By actively enforcing regulations and curbing anti-competitive practices, the FCCPC seeks to promote a competitive environment that benefits both businesses and consumers.

The FCCPC’s prohibition on PoS operators implementing the surge in transaction charges emphasizes its commitment to fair competition and consumer protection in Nigeria. By rejecting price fixing and announcing potential penalties for non-compliance, the regulatory body aims to foster an environment that encourages innovation, efficiency, and fair pricing for all stakeholders.

The investigation and collaboration with stakeholders, including the intervention by the CBN, demonstrate the importance of addressing concerns surrounding transaction charges in a comprehensive manner. Ultimately, the goal is to ensure that consumers are not unfairly burdened and that the Nigerian marketplace remains conducive to healthy competition and economic growth.