The Ghana Securities and Exchange Commission (SEC) has given Chipper Cash a broker-dealer licence. Chipper Cash is famous for international money transfers. Thanks to direct access to Ghana’s financial markets, Chipper Cash can now offer more services to consumers.

Jon Taylor Samson, CEO of Chipper Cash in Ghana, said, “It is essential for every entity that enters a market to adhere to the rules and regulations set by the regulatory bodies,” adding that it ensures business longevity and protects customers.

Read also: Kenya’s Central Bank to issue payment licences to Flutterwave, Chipper Cash, others

“We are excited to bring innovations in the financial market into the digital payment space.”

Chipper Cash: a new era in brokerage services

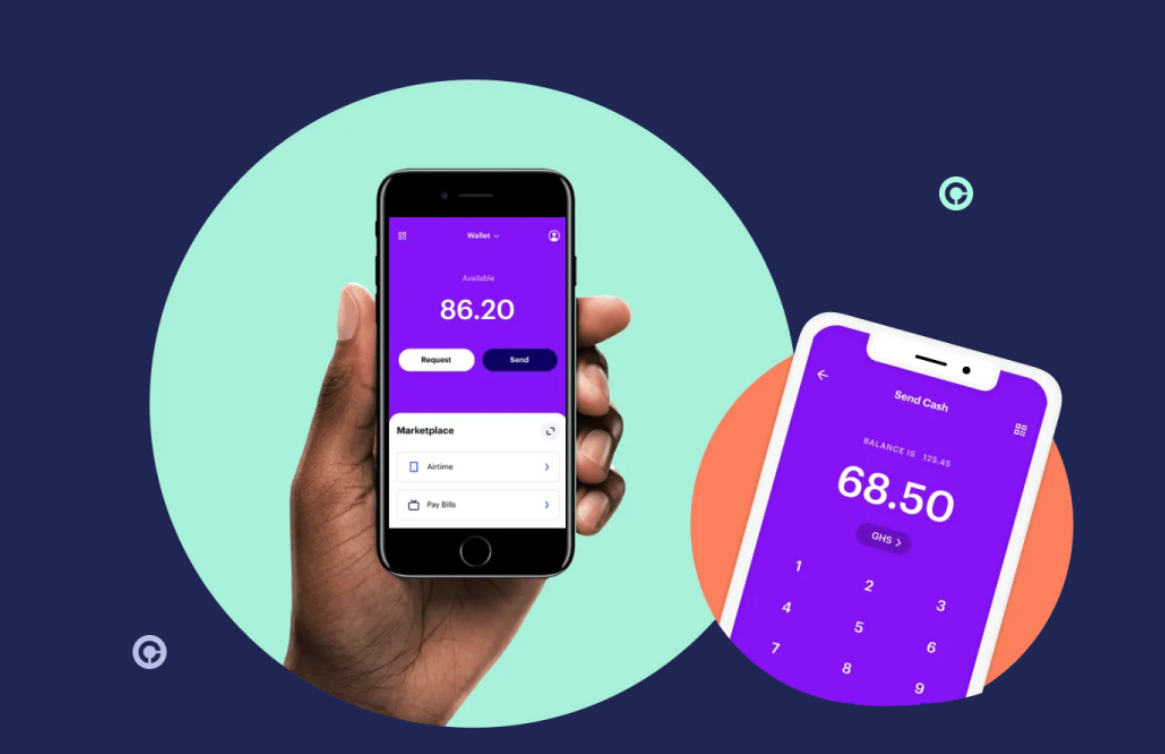

Thanks to the broker-dealer licence, Chipper Cash is now able to provide securities broking services to both individual and institutional clients. Customers can now purchase and sell stocks, bonds, and other securities within the Chipper Cash app.

Chipper Cash can also reach the market directly through the licence, which speeds up trades and makes prices more competitive. Chipper Cash is now ahead of rivals who don’t have the same advantages.

In an intelligent move, Chipper Cash bought a broker-dealer licence, which increased the company’s services and strengthened its position as Ghana’s top financial technology business. To give its customers access to investment possibilities, Chipper Cash empowers them to participate in the financial markets and possibly make money from their investments.

This shows that the market is fully developed and robust, suitable for Ghana’s banking system. Fintech companies like Chipper Cash are making the market more competitive and open to new ideas suitable for customers and businesses. As it expands, Chipper Cash will change the way money is handled in Ghana and around the world.

Read also: CBK to Give Payment Licenses to Fintech Startups

About Chipper Cash

While attending Grinnell College in Iowa in 2012, Ugandan CEO Ham Serunjogi met Ghanaian co-founder Maijid Moujaled. They were aware of the difficulties in sending money across Africa, but they came up with a solution during a road trip in 2016. They introduced Chipper Cash for business use 2018, enabling Africans to transfer money internationally in local currency.

It provides cross-border money transfer services across several African countries, including Nigeria, Uganda, Ghana, and South Africa.

With its user-friendly mobile app, Chipper Cash enables seamless and low-cost transactions, making it easier for individuals and businesses to send and receive money.

Through its brokerage service, the platform also offers additional services such as bill payments, cryptocurrency trading, and stock trading. By focusing on affordability and accessibility, Chipper Cash aims to democratise financial services in regions with limited access to traditional banking, making it a key player in Africa’s rapidly evolving fintech landscape.