Canada-based Be Mobile Africa has officially launched its branch in South Africa with a mission to make banking accessible to the unbanked and underbanked in the country. It also offers low-to-no-fee banking products through its mobile app.

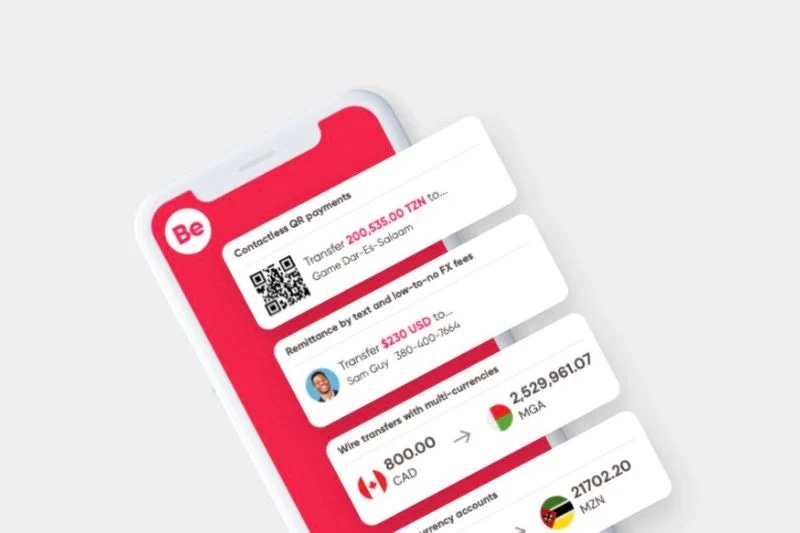

Neobank announced in a statement that explained how opening a Be Mobile Africa account would let customers hold, send, and receive money in multiple currencies, including USD and EUR.

The company also stated that customers would have the opportunity to send funds abroad in seconds and earn yearly interest in US and Euros with Be Mobile Africa’s savings.

Read Also: Nigeria’s Anchor Launches its Public Beta and Secures $1 Million in Pre-Seed Funding

According to the statement, “By opening a Be Mobile Africa account, customers can hold, send and receive funds in multiple currencies including USD and EUR, send money abroad in seconds and earn 5% interest per annum in USD and EUR with Be Mobile Africa’s savings offering.”

The company also says that customers of the bank will be able to send and receive money instantly and for free from anyone in the Be Mobile Africa network. They will also be able to exchange currencies with low foreign exchange fees.

“The company aims to accelerate financial inclusion throughout Africa by delivering innovative digital banking solutions to serve these users,” it said.

Dr Cédric Jeannot, CEO & co-founder of Be Mobile Africa, expressed excitement about launching in South Africa, which he said has potential growth.

“We are incredibly excited to be launching our services in South Africa. This is an important market for us, and we believe there is great potential for growth.”

The co-founder added that Be Mobile Africa’s central goal is to provide access to financial services for everyone on the African continent.

Oxford Business School has found that about 23.5% of South Africans do not have a bank account. It is thought that about R12 billion in cash is held outside of the banking system, and Be Mobile Africa wants to reach these people. The company aims to make banking accessible to unbanked and underbanked citizens.

Lemonade Finance expands its network across African markets

Be Mobile Africa will compete with other “neobanks” like Bettr, a subsidiary of Access Bank in South Africa.

The neobank is currently available in 30 countries across the continent, with future plans to expand to additional markets and launch its business services.

The Be Mobile app is available for Android and iOS devices and features an electronic FICA process, instantly authenticating and verifying users in real time during signup.