Nigerian digital bank OjirehPrime closes her pre-seed round with $1,240,000 infusion from some of the best investors.

Adedotun Sulaiman, a former chairman of the Interswitch Board, led this round, which also included former Heritage Bank director Mary Akpobome, the UK-based accelerator CPRES203, and several Nigerian-based angel investors.

OjirehPrime has had a long and fascinating journey, says Mr. Edoka Idoko, the company’s founder and CEO, “We began as a fintech company specializing in prepaid cards, acquired a microfinance bank, built a mobile app, attracted 450,000 customers, and are now closing our pre-seed investment after growing our prepaid card user base to 40,000 on our own.”

“As the saying goes, the voyage itself taught me the virtue of tenacity, “where there is a will, there is a way.” This allows us to enter a completely new stage in which we can draw in additional talent, enhance marketing, and better position the brand for scalability. Beyond traditional digital banking operations, OjirehPrime wants to develop cutting-edge products that would open up new revenue streams.”

“This launches us into a new stage in which we can hire more brilliant individuals, increase our marketing efforts, and better position the brand for expansion.”

Read also: Nigerian Digital Bank Umba Raises $15M Series A Round

OjirehPrime Launches Digital Bank With A Loan Without Interest

In 2016, OjirehPrime launched as an online grocery store. In 2018, she introduced her OjirehPrime prepaid card, which organically expanded to 40,000 users by 2020. They declared a strategic repositioning that set her on the path to establishing a digital bank in 2021 when they revealed their investment in Solid Allianze Microfinance Bank.

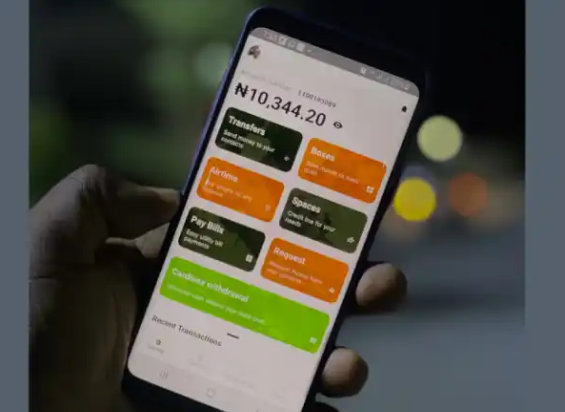

Ojirehprime takes pride in offering a digital bank that is more customer-centric and concentrates its resources on the various points at which it interacts with consumers to offer specialized banking services. OjirehPrime’s benefits include how simple it is to open a bank account in just 90 seconds, free interbank transfers, no account maintenance fees, creative saving features, interest-free loan options, and easy/quick access to your deposit via cardless withdrawal from any ATM.

As part of her business strategy, Ojirehprime is dedicated to giving her clients a satisfying experience.

According to Edoka Idoko, the founder and CEO of OjirehPrime, the company will promote growth by providing credit lines to its clients with a lifeline that enables the typical consumer to repay without incurring interest as long as the transaction is finished within the moratorium.

Only Android users can currently access it on Google Play under the name OjirehPrime, and Solid Allianze Microfinance Bank powers its savings account.

Nigerian fintech Payhippo acquires Maritime Microfinance Bank

OJirehPrime App Update

A digital bank called OjirehPrime provides more open, client-centered banking services, including free credit cards delivered right to your door and access to loans and cutting-edge savings products.

The Android operating system (OS) is about to launch a feature that might obstruct vital notifications from apps you only occasionally use. Because our software is currently available to users of Android phones, guaranteeing that you don’t miss any crucial notifications, it’s critical that we inform you about this upcoming improvement.

Beginning in November 2022, an update to Android OS will stop any apps you don’t frequently use by deleting temporary files and disabling notifications for any apps you haven’t used in the previous 90 days. On devices with OS 12 or later, the feature of app hibernation is available.

This will turn off Android’s app hibernation feature so you may use the OjirehPrime app whenever you want and never miss a notification. Some manufacturers (like Xiaomi and Samsung) handle your options in an unusual way. Please refer to the instructions provided by the manufacturer for your particular device.