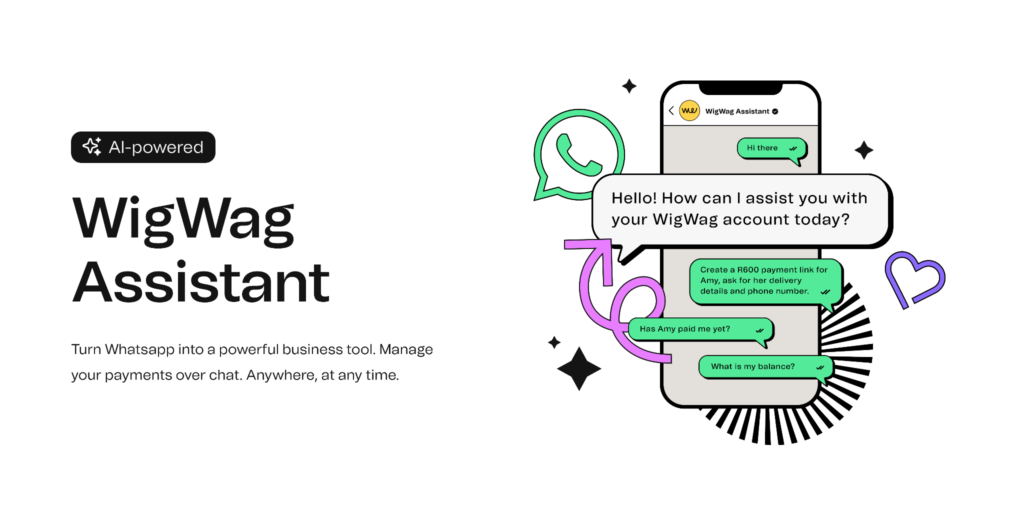

WigWag, a subsidiary of South African payment service provider Stitch, has introduced an AI-powered WhatsApp payment management bot aimed at simplifying payment processes for small and medium-sized enterprises (SMEs).

The new bot eliminates the need for businesses to juggle multiple apps and browsers to manage payments.

Targeting the SME Market

WigWag, which was launched in September 2023, is a new player in the payment space. Its parent company, Stitch, focuses on the enterprise market, providing businesses with solutions to accept, reconcile, and orchestrate payments, as well as oversee financial processes.

Danielle Laity, general manager at WigWag, explained the rationale behind establishing the subsidiary, stating, “Payments are not a one-size-fits-all. Startups, small businesses, independent contractors, and budding social sellers are still looking for an easy way to get paid – but without complex technical integrations while still receiving great service and reliable technology. We saw an opportunity to serve these businesses with an easy-to-use solution that runs on top of the Stitch infrastructure.”

Read also: WhatsApp provides AI powered conversations in chats

Utilising WhatsApp as a Key Platform

One of WigWag’s strategic moves is its use of WhatsApp as a primary platform to engage its target market. Citing a study by VodaFone and SafariCom, WigWag noted that WhatsApp is the most popular social media platform in South Africa, with an estimated 93% of internet users, roughly 23 million people, currently using the messaging app. This number is expected to increase to 28.6 million by 2026.

Meeting the Demand for Tap-to-Pay Offerings

The WigWag assistant is designed for business owners and operators who already interact with their clients on WhatsApp or manage other operational aspects of their business through the chat app. With SMEs and informal sellers making up 28.8% of South African businesses, many of which leverage social media for marketing and sales, WigWag sees a significant opportunity in this market.

Addressing concerns about mobile device security, Laity highlighted that WigWag is fully compliant with the Payment Card Industry Data Security Standard (PCI DSS), developed to protect transactions and cardholders’ personal information. The company has also implemented a thorough digital onboarding process to verify the legitimacy of businesses joining the platform.

WigWag’s Cost and Payment Structure

While there is no charge to open an account, WigWag applies a percentage fee per transaction, starting at 2.95% for local cards, with fees decreasing with transaction volume.

The launch of the AI-powered WhatsApp payment bot by WigWag demonstrates its commitment to providing SMEs with accessible and innovative payment solutions, leveraging the popularity and convenience of WhatsApp to streamline payment processes for businesses across South Africa.