Statutory Remittances in Africa, Africa’s first White Paper, was published today by Bento, a pan-African digital payroll and HRM platform with tax remittance capabilities.

The White Paper discusses taxation regimes in 53 African countries and the benefits of computerized payroll systems for precise income tax and other deductions.

Taxes pay for things like security, healthcare, education, and infrastructure. Numerous African countries’ tax systems don’t bring enough money to cover their wants. The vast informal industry that doesn’t pay taxes is to blame.

Currently, the informal industry does not use domestic resources well. That’s why African countries can’t get tax breaks from a field where 85% of their people work (90 of% in sub-Saharan Africa), according to the Bento research.

The failure of taxation systems has forced many countries to seek aid from the West. African states can no longer borrow from foreign governments to help them cope with a global economic recession.

Bento Co-Founder and CEO Ebun Okubanjo stated that African countries lose more than they receive in foreign development funding.

African countries lose at least $60 billion in taxes, more than foreign development aid and somewhat more than the DRC’s GDP, according to our White Paper. Embracing a digital revolution will free Africa from foreign aid. More effective tax collection is possible with our personnel and solutions. Reduced evasion and tax compliance can boost revenue from efficient tax collection, he noted.

Read also: South Africa’s SARS unveils plan to digitise VAT collection process

Digital tax collection could fix informal taxes

Taxation is challenging and requires careful planning to build an effective, equitable, and sustainable system, the study stressed. Maximum sector growth is best achieved through digital tax collection. African informal sector incomes are not taxed or regulated like PAYE.

According to the paper, the informal sector, which is largely unregulated, offers a missed opportunity for DRM. Since many Africans question how their taxes are spent, accountability has been their most significant issue. This recurring issue stresses the need for computerized tax collection approaches.

However, few African nations have employed computers to tax the unorganized sector. For instance, Rwanda and Ethiopia. Since they file and collect taxes on computers, technology may affect tax collection.

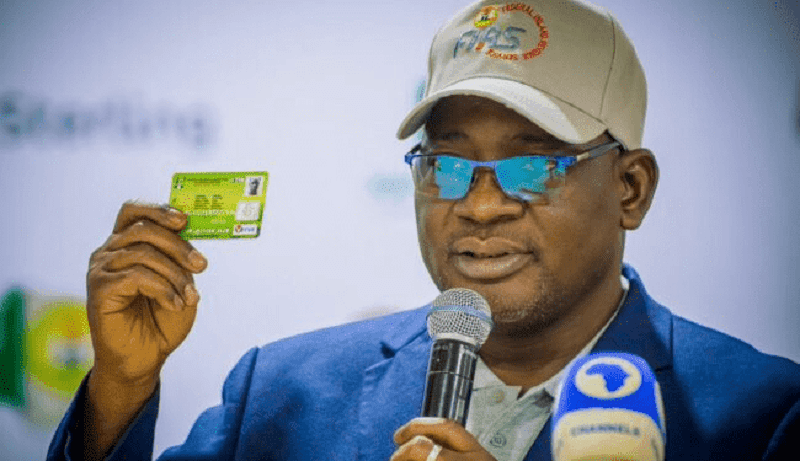

The Federal Inland Revenue Service (FIRS) and the Market Traders Association of Nigeria (MATAN) began using unified systems technology to collect and send VAT from MATAN’s members, largely unorganized sector workers, in July 2023. MATAN contains 36 states, 774 local administrations, and 40 million companies in the FCT.

A computerized instrument simplifies VAT collection and transmission in the informal and market sectors under the “VAT Direct Initiative”. Technology to list traders for VAT collection and Service submission would generate more revenue for the Federation and the company.

What will happen is unclear, but this partnership aims to reduce taxes, touting, and unlawful tax collectors while protecting informal business sites. It’s intended to increase tax revenue and State and Local Government revenue.

At verdict

The paper shows that technology-driven solutions can help close the taxation gap, notably for the informal sector, in Ethiopia and Rwanda. However, it suggests a robust database of informal sector actors to guide fiscal management decisions.

It also advises creating a taxation model that informal sector actors can easily use, and tax authorities can manage.

Bento software helps African governments prepare and submit tax returns and payments electronically, minimizing administrative overhead. Ebun Okubanjo, Bento CEO, said real-time reporting gives tax authorities current tax collection and trend data.