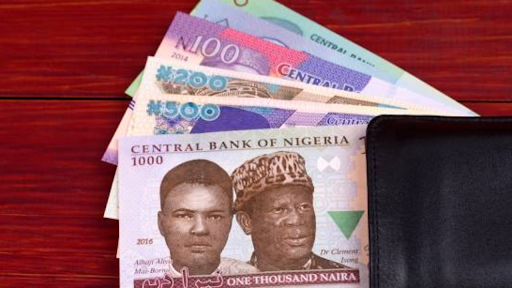

The Nigerian Central Bank (CBN) has revealed that it will replace the current designs of the N200, N500, and N1,000 bank notes with brand-new versions by the end of the year 2022.

In a special briefing that took place on Wednesday, the Governor of the Central Bank of Nigeria, Godwin Emefiele, made the announcement.

According to him, the existing Naira banknotes will cease to be acceptable forms of payment as of the 31st of January, 2023.

He explained that the motivation behind the apex bank’s decision to intervene in the management of the present series of banknotes and cash that is in circulation was the fact that it was required to do so. He made reference to the fact that figures demonstrated that 80 per cent of the money that was in circulation was not held in banks.

Read also: CBN Records 700,000 transactions worth N8 billion on eNaira

More On The Notes

“As of the end of September 2022, the figures that were available at the CBN indicated that N2.73 trillion out of the N3.23 trillion cash that was in circulation was outside the vaults of commercial banks across the country; and purportedly held by the public.”

He said that currency management in recent times had been confronted with major challenges that have continued to grow in scale and sophistication, with attendant and unintended consequences for the integrity of both the CBN and the country. He stated that these challenges have arisen in response to the fact that currency management has become increasingly complex.

He also cited other concerns, such as the deteriorating shortage of clean and fit banknotes, the increased ease of counterfeiting, and the risk of doing so, as indicated by various security studies.

“Despite the fact that it is considered to be a global best practice for central banks to create, produce, and circulate new local legal currency every 5–8 years, the Naira has not been redesigned in the past 20 years,”

This announcement comes just one day after the Central Bank of Nigeria (CBN) celebrated the first anniversary of the launch of the eNaira digital currency.

Financial Analysts’ Opinion

Regarding whether or not the new naira notes will have an impact on the economy, financial analysts have different opinions.

Professor of Capital Market Studies and Chairman of the Abuja Chapter of the Chartered Institute of Bankers of Nigeria, Prof. Uche Uwaleke, thought the move would reduce corruption and black money.

“Although the action does not equal to the demonetization of large currency notes, which central banks frequently carry out to combat black money and corruption, it would go a long way in guaranteeing that a lot of naira notes circulating outside the banks are crowded in,” he said.

“I anticipate that the Financial Intelligence Unit will be keeping an eye out for large deposits in order to keep an eye on unauthorized activities.

Prof. Oyinlola Olaniyi, an economist at the University of Abuja, agreed with him and stated that the decision would come as a huge shock to those who have been hoarding unrecoverable stolen money.

Olaniyi stated: take them to the bank. If you have stolen money and have been hoarding it inside your home because you know that if you bring it outside, you will be interrogated, that is precisely what governments are trying to accomplish.

The Central Bank Of Nigeria Unveils USSD Code For eNaira Transactions

Market Volatility on the Forex

According to some market observers, traders’ and investors’ concerns about the nation’s foreign currency market, which is already hurting the naira’s fate, have only grown.

A foreign exchange trader in Lagos told THISDAY that the current situation is unsafe and makes it risky to hold money in naira since no one knows what value the currency would command the next day.

Some analysts questioned why the local currency had defied the CBN’s intermittent interventions designed to stop the naira’s decline in value.

Nevertheless, when reached, Mr Aminu Gwadabe, President of the Association of Bureau de Change Operators of Nigeria (ABCON), claimed that the naira had not been able to react to some of the previous regulatory interventions because the apex bank had primarily focused on the wholesale end of the market, leaving the retail end, which is the largest, stranded.